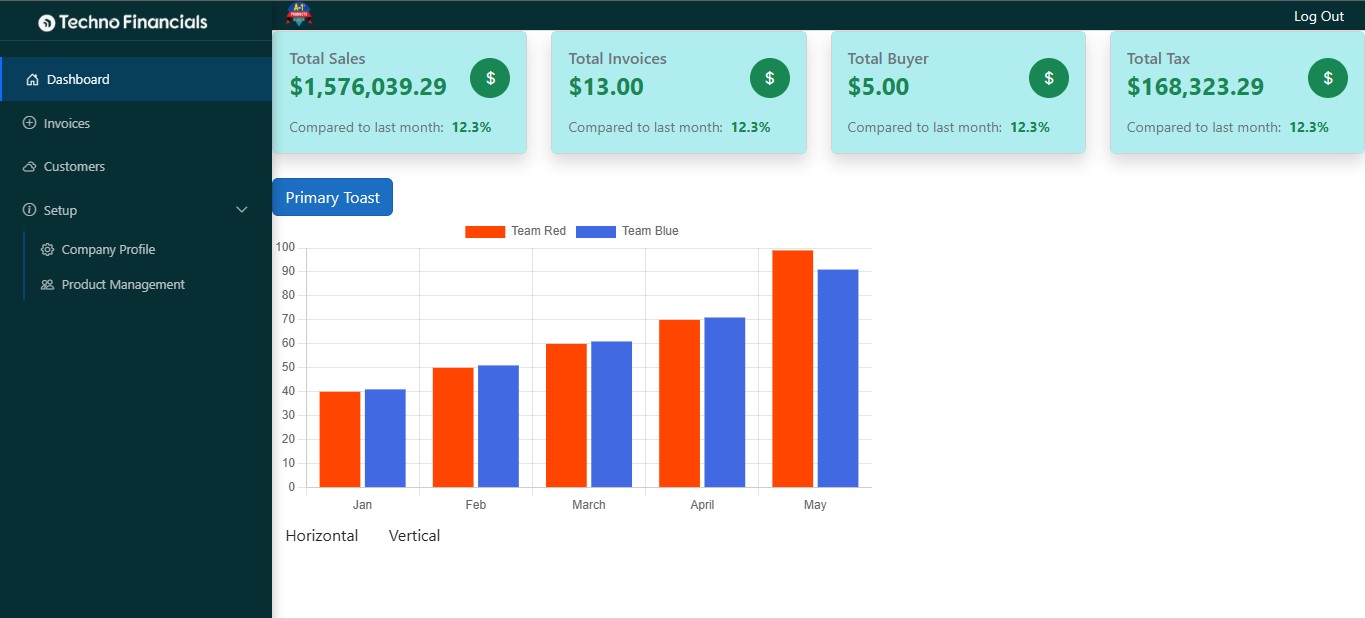

Digital Invoicing – Compliant

E-Invoicing Solution for Businesses in Pakistan

Techno Financials’ Digital Invoicing module is designed exclusively for businesses in Pakistan, ensuring full compliance with FBR’s S.R.O. 709(I)/2025. Whether you’re in retail, wholesale, distribution, pharma, or manufacturing, this solution helps you generate, report, and manage electronic invoices in real time with complete accuracy and regulatory alignment.

What is SRO 709?

On 22 April 2025, the Federal Board of Revenue (FBR) issued S.R.O. 709(I)/2025 under Section 50 of the Sales Tax Act, 1990.

It mandates that:

- All registered businesses (corporate & non-corporate) must issue fiscal e-invoices.

- Invoices must be reported in real time to FBR’s Invoice Verification System (IVS).

Each invoice must include:

- A unique FBR Invoice Number (IRN)

- QR code for verification

- JSON format with metadata

- A digital signature

- Businesses must maintain secure digital archives for 5–6 years

Deadlines set by FBR:

- Corporate entities → 1 July 2025

- Non-corporate entities → 1 August 2025

Techno Financials’ Digital Invoicing tool is pre-configured to handle all these compliance requirements seamlessly.

- Issue fiscal e-invoices

- Submit them to FBR in real time

- Include QR codes for authenticity

- Embed a unique FBR invoice number

- Use JSON format with valid metadata

- Apply digital signatures for verification

- Maintain secure archiving & audit trail (typically 5–6 years)

Techno Financials’ Digital Invoicing tool is pre-configured to handle all compliance requirements seamlessly under the 2025 rules.

Key Features of Our Pakistan-Specific Digital Invoicing Tool

FBR API Integration

Fully integrated with FBR’s Invoice Verification System (IVS) for real-time invoice submission, approval, and QR code generation.

Auto QR Code Generation

Each invoice includes a government-approved QR code, allowing easy verification via the FBR app or portal.

Digital Signature Support

Compliant with legal requirements for invoice verification and tax audits.

Sales Data Sync with FBR

Your sales records are automatically synced with the FBR portal, eliminating manual reporting and reducing the risk of penalties.

VAT-Compliant Invoice Formats

Invoices are generated in line with Pakistan’s sales tax structure, including detailed tax breakup, buyer NTN, and business activity codes.

Secure Archiving

All e-invoices are digitally stored with a full audit trail, making your business audit-ready at all times.

Multi-Branch Management

Manage invoicing and reporting for multiple branches across Pakistan from one centralized dashboard.

Starter Plan (Free)

For small businesses getting started.-

6 invoices per year.

-

Cloud-based access only

-

Integration with PRAL/FBR (compliance-ready)

-

Email & community support

-

Add-on: Purchase Digital Invoice Archiving

Professional Plan (Cloud)

For growing companies who need unlimited invoicing.-

Unlimited invoices

-

100% cloud-based (secure, anywhere access)

-

Advanced features (bulk upload, reporting, exports)

-

Integration with PRAL/FBR

-

Priority email & phone support

-

Subscription (monthly/annual)

-

Custom integrations (ERP, accounting, e-commerce, etc.)

-

Digital Invoice Archiving

Enterprise Plan (On-Site)

For large organizations needing control & customization.-

Unlimited invoices

-

On-premise deployment (your servers, your control)

-

Custom integrations (ERP, accounting, e-commerce, etc.)

-

Integration with PRAL/FBR

-

SLA-based premium support

-

One-time setup + annual maintenance

-

Digital Invoice Archiving

Why Choose Techno Financials’ Digital Invoicing?

100% compliant with S.R.O. 709(I)/2025, 1222(I)/2020 & 1006(I)/2021

Approved for real-time e-invoicing

Reduces manual work and errors

Designed for retail, pharma, FMCG, distribution & manufacturing

Ongoing updates as per FBR’s latest regulations

Ensures audit-readiness and transparency

Who Needs This?

Businesses in Pakistan operating in:

Wholesale & Manufacturing

Distribution

Retail (Tier-1)

E-commerce

Pharmaceutical & Healthcare

If your business is listed under SRO 1222(I)/2020 or SRO 1006(I)/2021, you are legally required to use FBR-integrated invoicing software.

Ready to Go Digital?

Stay compliant, organized, and efficient with Techno Financials’ Digital Invoicing module—built specifically for the Pakistani business landscape.

📍 Serving businesses across: Karachi, Lahore, Islamabad, Faisalabad, Multan, Rawalpindi & more.